The decentralized finance landscape has achieved remarkable growth but remains plagued by fundamental usability issues that prevent mainstream adoption, including complex wallet management, front-running exploitation, capital inefficiency, and user interfaces that alienate non-technical users. Dango emerges as a groundbreaking Layer-1 blockchain solution that addresses these critical barriers through innovative technology including wallet-less smart accounts, hybrid liquidity engines that eliminate MEV extraction, and automated on-chain task scheduling that simplifies DeFi complexity. With $3.6 million in seed funding from tier-1 investors including Hack VC and Delphi Ventures, and an unprecedented total supply of only 30,000 DNG tokens, Dango represents one of the most ambitious attempts to create user-centric DeFi infrastructure that bridges the gap between traditional finance accessibility and decentralized finance innovation.

Understanding Dango: The User-Centric DeFi Revolution

Dango stands as a pioneering Layer-1 blockchain project that fundamentally reimagines how users can interact with decentralized finance by eliminating the technical barriers and exploitation mechanisms that have prevented DeFi from achieving mainstream adoption despite its revolutionary potential. Founded with the vision of creating truly accessible financial infrastructure, Dango addresses the core contradictions in current DeFi systems where sophisticated financial products remain inaccessible to average users due to wallet complexity, key management requirements, and predatory trading practices that extract value from retail participants.

The platform's foundational philosophy centers on creating a DeFi ecosystem where users can access sophisticated financial services through familiar authentication methods including biometric verification and multi-factor authentication while maintaining the transparency, security, and non-custodial principles that define decentralized finance's value proposition. This approach recognizes that mass adoption requires user experiences that meet or exceed traditional financial services while providing the enhanced functionality and global accessibility that blockchain technology enables.

Dango's comprehensive approach encompasses not only user experience optimization but also fundamental improvements to DeFi infrastructure including the elimination of front-running through hybrid liquidity mechanisms, automated task execution that reduces operational complexity, and customizable fee structures that enable sustainable business models for applications built on the platform. These innovations address the systemic issues that have limited DeFi growth while creating opportunities for entirely new categories of financial applications.

The platform's commitment to developer empowerment through the Grug virtual machine and flexible infrastructure ensures that applications built on Dango can implement sophisticated business logic while maintaining the performance and cost characteristics necessary for competitive financial services. This developer-friendly approach creates opportunities for rapid ecosystem growth while ensuring that innovation remains aligned with user needs rather than technical limitations.

Dango's focus on enterprise adoption through customizable features and compliance-friendly architecture positions the platform to serve both retail users seeking accessible DeFi services and institutional clients requiring enterprise-grade functionality, creating diversified adoption pathways that reduce dependence on any single user segment while building sustainable revenue models.

Revolutionary Hybrid Liquidity Engine and MEV Protection

Dango's hybrid liquidity engine represents one of the most significant innovations in decentralized exchange technology, combining the precision of traditional orderbook systems with the flexibility and accessibility of automated market makers while implementing sophisticated mechanisms that eliminate the front-running and toxic arbitrage that extract value from retail traders. This hybrid approach addresses fundamental flaws in current DeFi trading systems where sophisticated actors exploit information asymmetries to profit at the expense of ordinary users.

The engine's implementation of low-latency oracles enables dynamic quote adjustments that respond to market conditions in real-time while maintaining fairness through sealed-bid, uniform-price auction mechanisms that prevent preferential execution for well-connected traders. These auctions ensure that all participants receive equal treatment while enabling efficient price discovery that benefits the entire ecosystem rather than privileged participants with technical advantages.

MEV elimination through the hybrid liquidity system protects retail traders from the extraction mechanisms that have made traditional DeFi trading disadvantageous for ordinary users while enabling sophisticated trading strategies for institutional participants who can benefit from advanced features without exploiting less sophisticated users. This protection creates sustainable trading environments where retail participation can grow without fear of systematic exploitation.

The platform's integration of orderbook precision enables complex trading strategies including limit orders, stop-losses, and sophisticated portfolio management while maintaining the accessibility and automated execution that makes AMM systems attractive to casual users. This combination provides professional-grade trading tools while preserving the simplicity that enables mainstream adoption.

Cross-collateralized margin accounts within the hybrid liquidity system enable capital-efficient trading strategies where users can leverage multiple asset positions simultaneously while implementing sophisticated risk management that prevents the cascading liquidations that can destabilize traditional margin systems. This approach maximizes capital efficiency while maintaining system stability through advanced risk monitoring and graduated liquidation mechanisms.

The liquidity engine's support for both fungible and non-fungible tokens enables innovative trading strategies that combine traditional DeFi with NFT markets while providing unified interfaces that simplify portfolio management across diverse asset types, creating opportunities for new financial products that bridge different crypto markets.

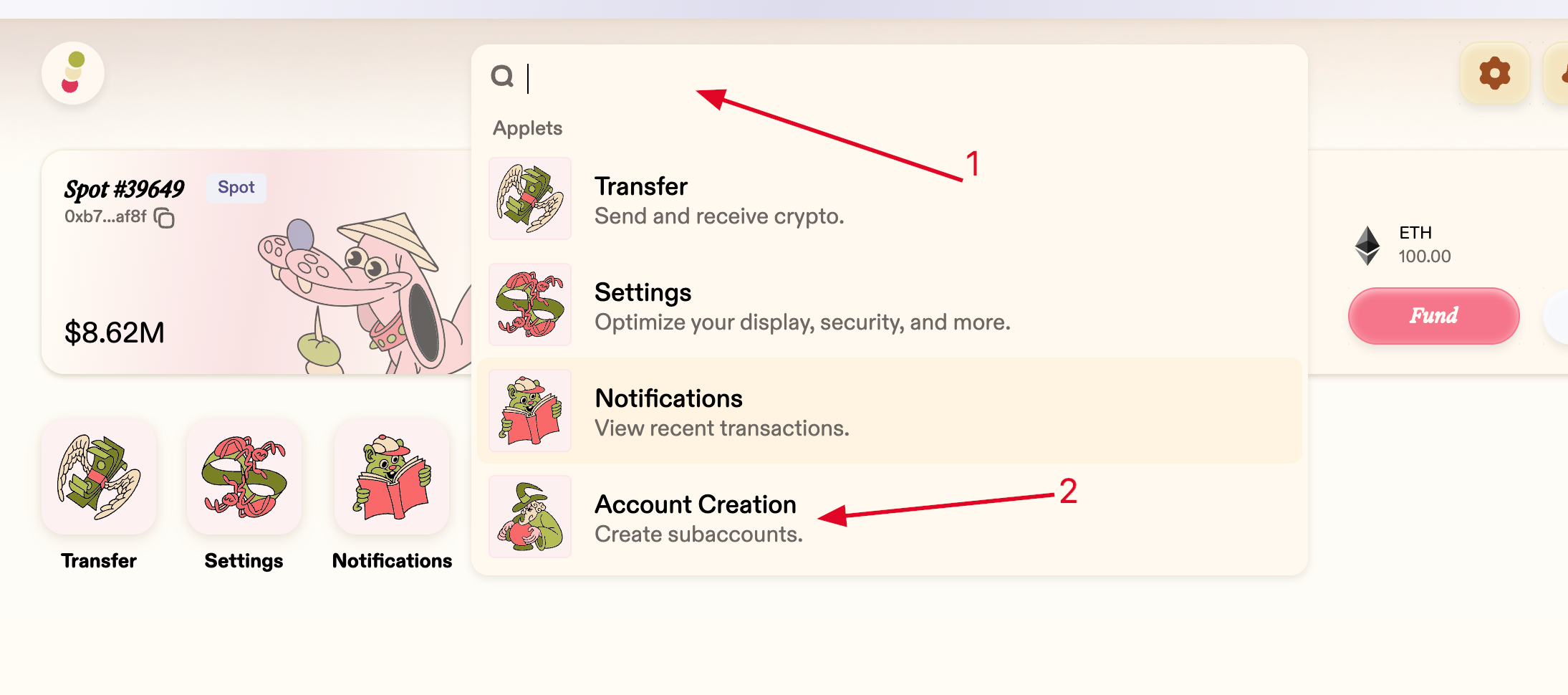

Smart Accounts and Wallet-Less User Experience

Dango's smart account system represents a revolutionary advancement in blockchain user experience that eliminates the complex private key management and seed phrase requirements that have prevented mainstream users from adopting cryptocurrency while maintaining the security and self-custody principles that define blockchain's value proposition. These programmable accounts implement sophisticated authentication mechanisms including biometric verification, hardware security keys, and multi-factor authentication that provide security guarantees exceeding traditional financial services.

The wallet-less experience enabled by smart accounts allows users to access DeFi services through familiar login methods while maintaining complete control over their assets through advanced cryptographic mechanisms that ensure only authorized users can access funds while eliminating the risk of lost keys or forgotten passwords that have resulted in billions of dollars in lost cryptocurrency.

Cloud-based private key storage with advanced encryption ensures that user credentials remain secure while accessible across multiple devices and platforms, creating seamless experiences that rival traditional financial applications while maintaining the transparency and auditability that distinguish decentralized finance from centralized alternatives. This approach addresses the primary barrier to mass adoption while preserving the fundamental benefits that make DeFi valuable.

Programmable account logic enables sophisticated automation including recurring payments, portfolio rebalancing, yield optimization, and risk management that can execute without user intervention while maintaining user-defined parameters and risk limits. This automation capability enables users to implement sophisticated financial strategies without requiring technical expertise or constant monitoring.

Multi-device synchronization ensures that users can access their accounts and assets from any device while maintaining consistent security standards and user experiences across platforms including mobile phones, tablets, desktop computers, and web browsers. This universal accessibility creates opportunities for DeFi adoption among users who primarily access financial services through mobile devices.

The smart account architecture supports social recovery mechanisms that enable trusted contacts to assist with account recovery while implementing sophisticated verification processes that prevent unauthorized access even from recovery contacts, creating safety nets that provide security without compromising user autonomy or introducing centralized control points.

Advanced Grug Virtual Machine and Developer Infrastructure

The Grug virtual machine represents a fundamental innovation in blockchain infrastructure that provides developers with unprecedented flexibility and control over application behavior while maintaining the security and deterministic execution that makes blockchain technology reliable for financial applications. Grug's integration with Dango's blockchain infrastructure enables sophisticated data flow management, automated task scheduling, and dynamic fee adjustment that creates opportunities for entirely new categories of decentralized applications.

Task scheduling capabilities through on-chain cron jobs eliminate the need for external automation services and centralized bots that introduce single points of failure and security vulnerabilities into DeFi protocols, enabling applications to implement sophisticated automation including funding rate adjustments, liquidity rebalancing, and yield compounding that operates transparently and reliably without external dependencies.

The virtual machine's support for the new Grug token standard addresses fundamental limitations in existing token standards including ERC-20's inability to handle multiple transfers atomically, lack of transfer rejection mechanisms, and separation between fungible and non-fungible tokens. The Grug standard enables complex transactions that combine multiple token types while implementing sophisticated logic that prevents fund loss and enables new categories of financial instruments.

Gas fee management through the Taxman smart contract provides unprecedented flexibility in fee structures while enabling dynamic adjustments based on network conditions, user types, and application requirements without requiring hard forks or protocol upgrades. This flexibility enables sustainable business models for applications while ensuring that fee structures remain optimal for different use cases and market conditions.

Developer tools and frameworks provided by the Grug ecosystem enable rapid application development while maintaining security and performance standards that ensure reliable operation under diverse conditions including high transaction volumes, market volatility, and network congestion. These tools reduce development time while ensuring that applications can scale effectively as user adoption grows.

The virtual machine's architecture supports complex financial logic including multi-asset derivatives, sophisticated lending mechanisms, and automated portfolio management while maintaining the transparency and auditability that regulatory compliance and institutional adoption require, creating opportunities for enterprise-grade applications that meet traditional finance standards.

DNG Token Economics and Scarcity Model

Dango's tokenomics implement one of the most unique approaches in cryptocurrency through an extremely limited total supply of 30,000 DNG tokens that creates unprecedented scarcity while supporting sophisticated utility mechanisms including transaction fees, governance participation, and ecosystem incentives. This ultra-low supply model suggests either a high-value token approach or represents innovative thinking about token distribution and value accrual that differs fundamentally from traditional cryptocurrency economics.

The deflationary mechanism implemented through USDC fee collection and DNG buyback-and-burn creates sustainable value accrual for token holders while maintaining accessible transaction costs for users who pay fees in familiar stablecoins rather than volatile cryptocurrencies. This approach ensures that network usage directly benefits token holders while removing price volatility concerns that can deter users from engaging with blockchain applications.

Governance functionality enables DNG holders to participate in crucial platform decisions including protocol upgrades, fee structure adjustments, validator selection, and ecosystem funding allocation while ensuring that the limited token supply creates meaningful voting power for each holder rather than diluting influence across massive token supplies that characterize many governance tokens.

The community incentive allocation of 1% of future token supply through partnerships with platforms like Galxe demonstrates commitment to building engaged user communities while maintaining scarcity through limited distribution mechanisms that reward genuine participation rather than passive speculation.

Fee structure innovation enables users to pay transaction costs in USDC while creating demand for DNG through systematic buybacks that reduce circulating supply over time, creating sustainable tokenomics that benefit both users who want predictable costs and token holders who benefit from deflationary pressure and increasing scarcity.

Staking and validator mechanisms within the proof-of-authority system create additional utility for DNG tokens while implementing governance safeguards that prevent centralization by ensuring validators focus on network security rather than revenue extraction, maintaining the performance and reliability that enterprise applications require.

Proof-of-Authority Consensus and Network Governance

Dango's implementation of proof-of-authority consensus with approximately 20 carefully selected validators represents a pragmatic approach to blockchain governance that prioritizes performance, security, and regulatory compliance while addressing legitimate concerns about decentralization through innovative governance mechanisms that separate validator operations from token-based influence. This approach enables enterprise-grade performance while maintaining transparent operations and community oversight.

Validator selection by the Left Curve Foundation implements rigorous criteria including technical competence, geographic distribution, and commitment to network health while ensuring that validators focus on infrastructure provision rather than profit extraction through MEV or fee manipulation. This approach creates sustainable incentive alignment while preventing the validator capture and centralization issues that affect many proof-of-stake networks.

The separation of validator operations from governance authority ensures that network consensus remains focused on technical performance while community governance through DNG tokens maintains democratic control over protocol development, fee structures, and strategic decisions. This separation prevents conflicts of interest while enabling specialized expertise in both network operations and community representation.

Network performance benefits from the PoA approach include predictable block times, consistent transaction throughput, and immediate finality that enables real-time applications including high-frequency trading and automated portfolio management that require guaranteed execution within specific time windows. These performance characteristics create competitive advantages for financial applications while maintaining security standards.

Geographic distribution and redundancy among validators ensure network resilience while implementing sophisticated monitoring and automatic failover mechanisms that maintain service availability even during individual validator outages or maintenance periods. This reliability enables enterprise adoption while building user confidence in platform stability.

Governance evolution mechanisms enable community-driven transitions to alternative consensus models as the platform matures and requirements change, ensuring that early design decisions don't prevent future optimization while maintaining stability during critical growth phases when reliability takes precedence over theoretical decentralization.

Strategic Funding and Investor Validation

Dango's successful $3.6 million seed funding round led by tier-1 venture capital firms including Hack VC and Delphi Ventures provides both financial resources and strategic validation from investors with extensive experience in DeFi infrastructure and blockchain technology development. This funding demonstrates sophisticated investor recognition of Dango's potential to address fundamental DeFi usability issues while building sustainable competitive advantages in the evolving financial technology landscape.

The participation of Lemniscap, Cherry Ventures, Interop, and Public Works creates a diverse investor base with complementary expertise in areas including technical development, business development, regulatory compliance, and market expansion that provides Dango with access to specialized knowledge and industry connections that accelerate development and adoption.

Strategic guidance from experienced DeFi investors helps ensure that Dango's development priorities remain aligned with market needs while avoiding common pitfalls that have affected other blockchain projects seeking to balance innovation with practical utility and sustainable business models. This investor involvement creates accountability while providing access to lessons learned from previous investments.

Funding allocation toward technical development, security audits, and ecosystem growth demonstrates commitment to building robust infrastructure rather than pursuing marketing-driven adoption that may not sustain long-term success. This approach creates foundations for sustainable growth while building confidence among developers and users who require reliable infrastructure for critical applications.

The investor network provides access to potential enterprise clients, partnership opportunities, and additional funding rounds that support continued development while enabling Dango to maintain focus on technical excellence and user experience optimization rather than constant fundraising activities that can distract from product development.

Market validation through sophisticated investor participation creates credibility that facilitates partnerships, talent acquisition, and user adoption while demonstrating that experienced industry participants recognize Dango's potential to capture significant market share in the expanding DeFi ecosystem.

Testnet Development and Community Building

Dango's comprehensive testnet program demonstrates systematic approach to product development that prioritizes user feedback and iterative improvement while building engaged communities of early adopters who can provide valuable insights for mainnet optimization. The phased testnet rollout enables controlled feature introduction while maintaining network stability and security during critical development phases.

Phase 1 testnet launch in March 2025 focused on core functionality validation while implementing incentive mechanisms that encourage genuine testing rather than superficial participation, creating communities of users who understand platform capabilities and can provide meaningful feedback for improvement. This approach builds advocacy while ensuring that feedback comes from informed users rather than casual participants.

The expansion to Phase 1.5 in May 2025 demonstrated responsive development that incorporates user feedback while maintaining development momentum, showing commitment to iterative improvement and community-driven development that prioritizes user needs over predetermined feature sets. This flexibility creates confidence in the team's ability to adapt to changing requirements and market conditions.

Community incentives through partnerships with Galxe and other platforms create structured participation opportunities while building social proof and awareness that supports broader adoption when mainnet launches. These incentive programs reward genuine engagement while creating educational opportunities that prepare users for effective platform utilization.

The planned progression through Phase 2 and Phase 3 testing creates predictable development timelines while enabling systematic feature rollout that maintains network stability and user experience quality throughout the testing process. This structured approach reduces launch risks while building confidence among users and investors.

Active community engagement through social media and direct feedback channels creates collaborative development environments where user needs drive feature prioritization while maintaining technical excellence and security standards that ensure platform reliability for critical financial applications.

Investment Analysis and Market Positioning

Potential investors evaluating Dango should consider the unique risk-reward profile created by the platform's innovative approach to DeFi infrastructure while recognizing both the significant opportunities and challenges associated with pre-launch blockchain projects seeking to capture market share in the competitive DeFi sector. The platform's focus on user experience and MEV elimination addresses genuine market needs while requiring successful execution of complex technical and business strategies.

The ultra-low token supply of 30,000 DNG creates unprecedented scarcity that could drive significant value appreciation if the platform achieves meaningful adoption, while also creating potential liquidity challenges and accessibility concerns that could limit broader participation. This tokenomics approach represents either innovative value accrual mechanisms or potential design limitations that require careful evaluation.

Technology risks include the complexity of implementing hybrid liquidity engines and smart account systems while maintaining security and performance standards that meet user expectations for financial applications. The proof-of-authority consensus approach provides performance benefits while creating centralization concerns that may limit appeal among decentralization advocates.

Market opportunity analysis suggests significant potential for platforms that successfully address DeFi usability issues while eliminating MEV extraction, particularly as institutional adoption accelerates and regulatory frameworks develop that favor compliant and user-friendly platforms over technically sophisticated but inaccessible alternatives.

Competitive challenges include established DeFi platforms with large user bases and liquidity networks while new projects with similar user experience focuses compete for developer attention and user adoption. Dango's comprehensive approach provides differentiation while requiring execution across multiple technical and business dimensions simultaneously.

The pre-launch status creates both opportunities for early participation and risks associated with unproven technology and uncertain launch timelines, requiring careful evaluation of development progress and team execution capability while recognizing that successful early-stage blockchain investments often require patience and tolerance for development uncertainties.

For investors seeking exposure to innovative DeFi infrastructure with potential for transformative impact on cryptocurrency accessibility and adoption, Dango represents a unique opportunity to participate in the development of next-generation financial technology while requiring careful consideration of execution risks and competitive dynamics that will determine success in the evolving DeFi landscape.