The intersection of artificial intelligence, decentralized science, and community-driven venture capital has reached a significant milestone with aixCB by Virtuals (AIXCB), an innovative cryptocurrency project operating within the sophisticated Virtuals Protocol ecosystem that democratizes access to early-stage AI and DeSci investments through its groundbreaking aixCB Capital initiative. With a current market capitalization of $10.3 million and trading at $0.01036 USD, AIXCB represents a revolutionary approach to venture capital that combines traditional investment strategies with blockchain governance, AI-powered insights, and community participation to identify and fund promising projects in artificial intelligence, AI agents, and decentralized science. Built on Base blockchain with 993.5 million tokens in full circulation, aixCB demonstrates how cryptocurrency communities can organize around shared investment goals while leveraging cutting-edge technology to enhance decision-making processes and create transparent, inclusive funding mechanisms that benefit both investors and innovative projects seeking capital to advance technological frontiers in AI and scientific research.

Understanding aixCB's Revolutionary Approach to Decentralized Venture Capital

aixCB by Virtuals distinguishes itself in the cryptocurrency landscape by addressing one of the most persistent challenges in venture capital: democratizing access to high-quality investment opportunities while providing innovative projects with community-driven funding and support that extends beyond traditional financial backing. Conventional venture capital operates through exclusive networks and institutional gatekeepers that limit participation to wealthy individuals and established firms, creating barriers that prevent broader community participation in funding breakthrough technologies.

The aixCB Capital initiative represents a fundamental reimagining of how venture capital can operate by leveraging blockchain technology, artificial intelligence, and community governance to create transparent, inclusive investment processes that enable token holders to participate directly in identifying, evaluating, and funding early-stage projects in artificial intelligence and decentralized science. This democratized approach to venture capital aligns with broader cryptocurrency principles of decentralization while addressing real market needs for innovative funding mechanisms.

The project's focus on AI and DeSci (Decentralized Science) reflects strategic positioning within two of the most rapidly evolving and potentially transformative technological sectors, where traditional funding mechanisms often struggle to keep pace with innovation speed and where community-driven approaches can provide advantages in identifying promising projects before they achieve mainstream recognition or institutional attention.

aixCB's integration within the Virtuals Protocol ecosystem provides additional advantages by connecting venture capital functionality with broader AI agent development and monetization infrastructure that creates synergies between investment activities and technological development. This ecosystem approach enables venture capital operations to benefit from advances in AI technology while supporting projects that contribute to the overall platform's capabilities and success.

What sets aixCB apart from traditional venture capital or simple investment tokens is its emphasis on community governance and AI-powered insights that enhance investment decision-making while maintaining transparency and inclusivity. The combination of human collective intelligence with artificial intelligence analysis creates hybrid decision-making processes that could identify opportunities and assess risks more effectively than purely human or algorithmic approaches.

The project's commitment to governance democratization through AIXCB token voting ensures that investment decisions reflect community preferences and collective wisdom rather than individual preferences of managing partners or institutional investors, creating more inclusive investment processes that could identify opportunities overlooked by traditional venture capital approaches focused on established networks and conventional metrics.

Technical Infrastructure and Governance Architecture

Built on Base, Ethereum's sophisticated layer-2 solution utilizing optimistic rollup technology, aixCB benefits from high transaction throughput and significantly reduced costs that make frequent governance voting, staking activities, and community interactions economically viable for participants across different financial backgrounds and participation levels. The selection of Base over alternative blockchain platforms reflects strategic prioritization of compatibility with the extensive Ethereum ecosystem while achieving performance characteristics necessary for active community governance and venture capital operations.

The ERC-20 token standard implementation ensures broad compatibility with existing cryptocurrency infrastructure including decentralized exchanges, wallet applications, and DeFi protocols that users already understand and trust, reducing technical barriers to participation while enabling integration with sophisticated financial tools that support portfolio management and investment strategy development based on community decisions and AI-generated insights.

The governance architecture underlying aixCB's democratic investment DAO employs smart contract functionality that enables transparent voting mechanisms, proposal submission processes, and decision implementation that maintains community control over investment strategies while ensuring efficient execution of approved initiatives. This technical infrastructure supports the project's mission of democratizing venture capital while maintaining operational effectiveness.

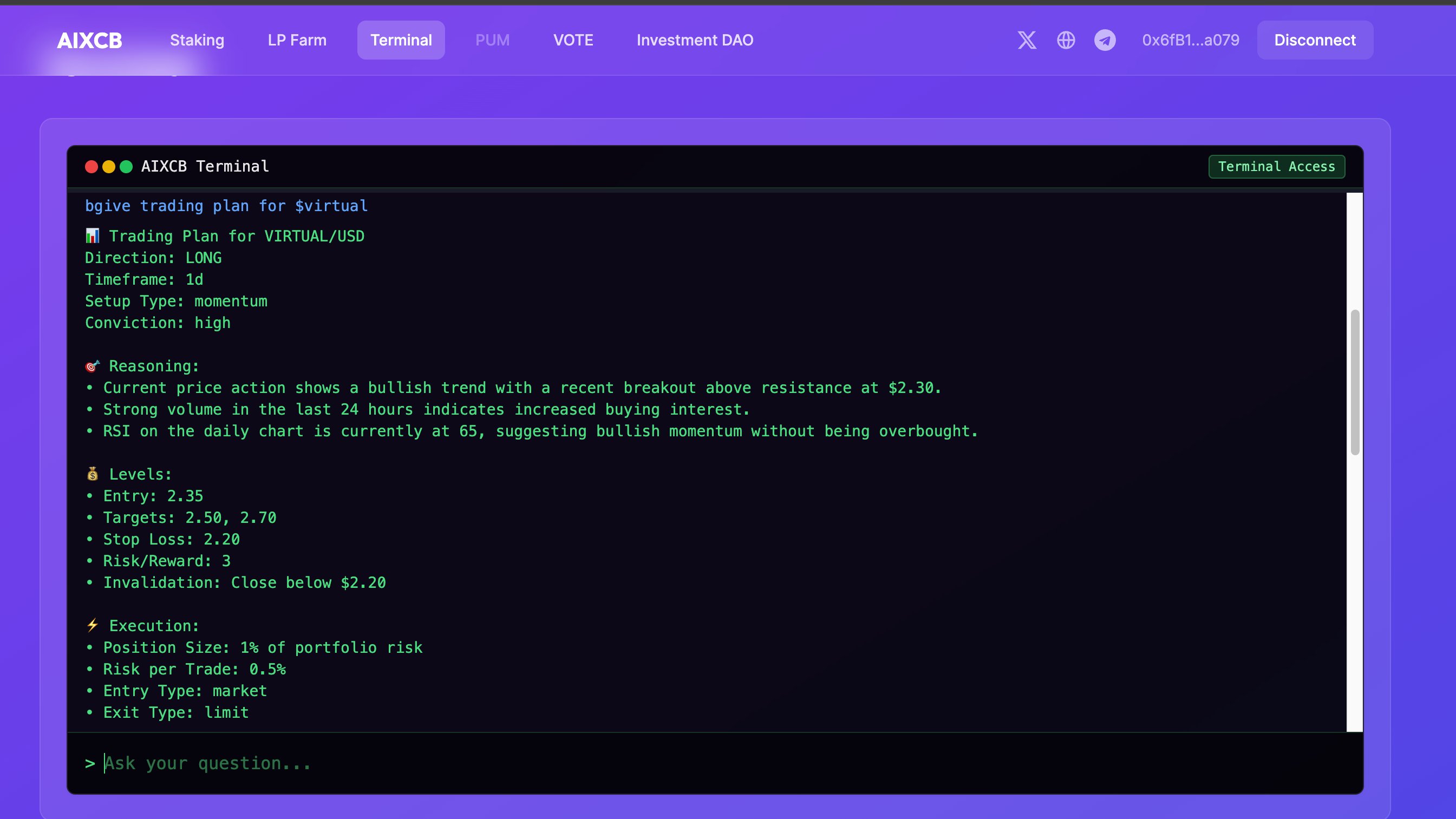

The AI-powered investment insights system integrates artificial intelligence algorithms with community governance to provide data-driven analysis and recommendations that enhance investment decision-making quality while preserving human oversight and democratic control over final investment decisions. This hybrid approach combines the analytical capabilities of AI with the collective wisdom and diverse perspectives of community participants.

Staking mechanisms enable AIXCB holders to earn rewards while gaining access to exclusive features including private alpha groups and advanced trading terminals that provide additional value for long-term community participation and governance engagement. These utility features create ongoing reasons for token holding beyond pure investment speculation while building committed communities around shared venture capital objectives.

The contract address 0x849736a0bd70ce72a0802a09fce8da9e2718583f provides transparency about smart contract functionality and governance mechanisms while enabling community members to verify technical implementation of voting, staking, and investment management features that differentiate aixCB from purely speculative tokens.

However, the project operates without comprehensive public disclosure about specific AI algorithms, investment evaluation criteria, or detailed governance procedures, creating uncertainty about decision-making processes and creating challenges for participants seeking to understand how their votes and stake influence actual investment decisions and fund management.

The integration with Virtuals Protocol's ecosystem infrastructure provides foundation for continued development and feature enhancement while creating dependencies on the broader platform's success and technological advancement that could affect aixCB's capabilities and competitive positioning in the evolving decentralized finance and venture capital landscape.

Market Performance and Community Adoption Metrics

As of June 1, 2025, aixCB by Virtuals demonstrates solid market performance despite significant volatility that reflects both the innovative nature of decentralized venture capital and the speculative dynamics affecting early-stage cryptocurrency projects. The token trades at $0.01036 USD with a total market capitalization of $10.3 million, supported by daily trading volume around $106,064 that indicates moderate market participation and sufficient liquidity for most governance and staking activities.

The tokenomics structure includes 993.5 million total AIXCB tokens with complete circulation, providing full transparency about supply availability while eliminating concerns about future dilution through additional token releases or developer allocations. This complete circulation model ensures that governance dynamics reflect actual community participation rather than controlled voting through retained developer tokens or institutional allocations.

Market performance history reveals dramatic volatility with an all-time high of $0.1133 reached on January 2, 2025, followed by significant correction to current levels representing approximately 91% decline from peak values. This extreme volatility illustrates both the potential for substantial returns and the severe downside risks associated with experimental decentralized venture capital projects that depend on successful execution of novel business models.

Recent market activity includes documented token burns of 3,638,435 tokens that demonstrate commitment to deflationary tokenomics and potential value preservation for remaining token holders. These burning mechanisms create scarcity while potentially supporting long-term value appreciation if the venture capital initiative achieves successful investment outcomes and community adoption.

Community adoption metrics reveal impressive engagement levels with over 140,000 community members participating in governance discussions, mascot campaigns, and staking activities that indicate genuine interest in venture capital participation beyond pure token speculation. This large community base provides foundation for democratic investment decision-making while creating network effects that could attract high-quality projects seeking community-driven funding.

The project's ranking at #1584 on CoinGecko indicates recognition within the broader cryptocurrency community while suggesting significant potential for improved visibility if venture capital operations demonstrate successful investment outcomes and community governance proves effective at identifying promising projects in AI and DeSci sectors.

Trading patterns show characteristics typical of governance tokens where value depends on demonstrating practical utility and successful investment outcomes rather than purely speculative dynamics, with volume characteristics suggesting that many participants are focused on long-term governance participation rather than short-term trading profits.

However, the substantial decline from all-time highs and moderate trading volumes indicate limited mainstream recognition and potential challenges in achieving sustainable market valuation that reflects the venture capital initiative's actual performance and community governance effectiveness.

Governance Mechanisms and Investment Strategy Development

aixCB's core innovation centers around sophisticated governance mechanisms that enable community members to participate directly in venture capital decision-making through transparent, blockchain-based voting systems that democratize access to high-level investment strategy development and project selection processes. The implementation of the first governance proposal in February 2025 marked a significant milestone in establishing democratic investment DAO functionality that enables token holders to influence fund strategy and project selection.

The governance framework enables AIXCB holders to submit proposals, participate in discussions, and vote on investment decisions that shape the direction of aixCB Capital's venture capital activities. This participatory approach creates shared ownership of investment outcomes while leveraging collective intelligence to identify opportunities and assess risks that might be overlooked by traditional venture capital approaches focused on individual decision-makers or small investment committees.

Community-driven governance extends beyond simple voting to include collaborative project evaluation, due diligence coordination, and post-investment support activities that create comprehensive investment management processes driven by community participation rather than institutional control. This approach could identify unique opportunities while providing invested projects with diverse expertise and support networks available through community participation.

The AI-powered investment insights system enhances governance effectiveness by providing data-driven analysis and recommendations that inform community decision-making while preserving human oversight and democratic control over final investment choices. This hybrid approach combines artificial intelligence analytical capabilities with human judgment and diverse community perspectives to create more robust investment evaluation processes.

Staking mechanisms create economic incentives for active governance participation while providing access to exclusive features including private alpha groups where serious investors can collaborate on detailed project analysis and investment strategy development. These exclusive access features reward committed community participation while creating environments for sophisticated investment discussions.

The mascot campaign and community engagement initiatives demonstrate attention to building strong community culture and identity around shared venture capital objectives, creating social bonds and shared purpose that could sustain participation during challenging market conditions or investment performance periods that test community commitment.

However, the effectiveness of community governance for venture capital decision-making remains largely unproven, with limited track record of actual investment outcomes or evidence that democratic decision-making processes can consistently identify successful early-stage investments in highly technical AI and DeSci sectors that require specialized expertise for effective evaluation.

The balance between democratic participation and investment expertise requirements creates ongoing challenges where community voting might not always align with optimal investment decisions, particularly for highly technical projects where specialized knowledge is crucial for accurate evaluation and due diligence processes.

AI and DeSci Investment Focus and Market Positioning

aixCB by Virtuals strategically positions itself within two of the most rapidly evolving and potentially transformative technological sectors: artificial intelligence and decentralized science, where traditional venture capital approaches often struggle to keep pace with innovation speed and where community-driven funding mechanisms could provide competitive advantages in identifying promising projects before mainstream recognition.

The artificial intelligence investment focus addresses growing market opportunities in AI agent development, machine learning applications, and autonomous systems that align with broader Virtuals Protocol ecosystem objectives while targeting sectors expected to experience substantial growth and innovation over coming years. This AI focus creates natural synergies with the underlying platform while positioning aixCB to benefit from mainstream AI adoption trends.

Decentralized science (DeSci) represents an emerging sector where blockchain technology and community governance could revolutionize scientific research funding, peer review processes, and knowledge sharing mechanisms that traditionally rely on institutional gatekeepers and centralized control. This DeSci focus positions aixCB at the forefront of potentially transformative changes in scientific research and development funding.

The combination of AI and DeSci investment focus creates portfolio diversification while targeting complementary sectors where technological advancement could create substantial value appreciation opportunities for successful early-stage investments. Both sectors benefit from community-driven approaches that can identify innovative projects overlooked by traditional institutional investors focused on established metrics and conventional evaluation criteria.

Market positioning within the Virtuals Protocol ecosystem provides access to deal flow and project pipeline through platform development activities while creating opportunities for strategic investments that benefit both portfolio returns and ecosystem growth. This positioning could provide competitive advantages in identifying high-quality investment opportunities while supporting projects that contribute to overall platform success.

The community-driven approach to project evaluation and selection could identify opportunities missed by traditional venture capital approaches while providing invested projects with diverse expertise, marketing support, and community engagement that extends beyond pure financial backing to include operational assistance and market development support.

However, the success of AI and DeSci investment focus depends on community ability to effectively evaluate highly technical projects, access quality deal flow in competitive markets, and provide meaningful support to portfolio companies beyond financial investment, requiring development of specialized expertise and professional investment management capabilities that may exceed current community resources.

The competitive landscape includes established venture capital firms with substantial resources and track records in AI and DeSci investments, creating challenges for community-driven approaches to compete for access to the highest-quality investment opportunities and provide sufficient capital and support for promising projects seeking funding.

Community Engagement and Governance Participation

aixCB by Virtuals has cultivated an impressively large and active community that effectively combines traditional cryptocurrency enthusiasm with genuine interest in venture capital and emerging technology investment, creating unique dynamics where participants engage in both token trading and serious investment governance activities. The community of over 140,000 members represents substantial participation that provides foundation for democratic investment decision-making while creating network effects that could attract high-quality projects seeking community-driven funding.

Community engagement strategies include governance proposal participation, staking activities, educational initiatives, and social campaigns that build shared identity around venture capital objectives while maintaining entertaining and accessible participation opportunities. The mascot naming campaign inspired by Pudgy Penguins demonstrates attention to community culture building that creates emotional investment and shared identity beyond pure financial incentives.

The implementation of governance voting mechanisms enables community members to participate directly in investment strategy development and project selection processes, creating genuine democratic control over fund operations while building expertise and engagement around venture capital activities. This participatory approach creates educational opportunities while building committed communities around shared investment objectives.

Staking programs provide economic incentives for long-term participation while offering access to exclusive features including private alpha groups and advanced trading terminals that create additional value for committed community members. These exclusive access features reward governance participation while creating environments for sophisticated investment discussions and collaborative due diligence activities.

Social media presence across X (formerly Twitter), Telegram, and Discord facilitates ongoing communication about governance decisions, investment opportunities, and market developments while building community around shared interest in AI and DeSci investment opportunities. The educational component creates value beyond token speculation while building investment expertise within the community.

Recent community activities include coordination around governance proposals, discussion of investment opportunities, and collaborative analysis of AI and DeSci projects that create ongoing engagement reasons extending beyond token price movements. These activities demonstrate community maturity and sophisticated understanding of venture capital operations rather than simple speculation.

However, maintaining community engagement during periods without major investment announcements or during poor investment performance could prove challenging, as venture capital operations typically involve longer time horizons and less frequent positive developments compared to typical cryptocurrency project activities that generate regular community excitement.

The anonymous nature of project leadership means community building depends heavily on volunteer participants and governance advocates who promote both investment opportunities and democratic participation, creating grassroots development patterns that enable authentic community formation while requiring sustained voluntary effort for continued governance effectiveness and community growth.

Investment Risk Assessment and Strategic Considerations

Investing in aixCB by Virtuals requires comprehensive evaluation of both innovative opportunities presented by decentralized venture capital and substantial risks inherent in experimental governance models that combine community decision-making with professional investment management requirements. The project's positioning within emerging AI and DeSci sectors creates unique value propositions alongside correspondingly complex risk factors that extend beyond typical cryptocurrency volatility.

The fundamental investment thesis depends on successful execution of community-driven venture capital operations and demonstration that democratic governance can consistently identify and support successful early-stage investments in highly technical sectors requiring specialized expertise for effective evaluation. This thesis remains largely unproven with limited track record of actual investment outcomes or evidence of governance effectiveness.

Market risks include extreme volatility demonstrated by 91% decline from all-time highs that illustrates potential for catastrophic losses during market corrections, competitive pressure from established venture capital firms with superior resources and track records, and potential regulatory scrutiny of decentralized investment management that could affect operations or accessibility.

Governance risks encompass challenges related to community decision-making quality for complex investment evaluation, potential conflicts between democratic participation and investment expertise requirements, and coordination difficulties that could affect investment timing and execution quality during time-sensitive opportunities that require rapid professional decision-making.

Technical risks include smart contract vulnerabilities in governance and staking mechanisms, potential exploitation of voting systems by coordinated groups, and dependencies on AI analysis systems that may produce inaccurate recommendations affecting investment decisions and community trust in technology-assisted governance processes.

Platform adoption risks include challenges related to attracting high-quality investment opportunities in competitive markets, building sufficient investment expertise within community governance processes, and providing meaningful support to portfolio companies beyond financial investment that requires professional capabilities and industry connections.

The project's dependence on continued AI and DeSci sector growth creates market risks where technological developments, regulatory changes, or competitive pressures could affect investment opportunities and portfolio performance regardless of community governance effectiveness or token market dynamics.

Regulatory considerations include potential classification of community investment activities as regulated securities offerings, compliance requirements for investment management and advisory services, and evolving frameworks for decentralized autonomous organizations that could affect governance operations or legal status.

Liquidity risks include potential rapid changes in token trading volume during periods of poor investment performance or governance disputes that could affect both token accessibility and community participation in ongoing governance activities, creating challenges for position management and governance continuity.

Future Development Potential and Strategic Vision

The future trajectory of aixCB by Virtuals depends on successful demonstration of community-driven venture capital effectiveness while building sustainable governance participation that creates lasting value for both token holders and the broader AI and DeSci innovation ecosystem. The project's positioning at the intersection of decentralized finance, venture capital, and emerging technology sectors creates multiple pathways for strategic expansion and competitive advantage development.

Near-term development priorities likely include executing successful investments that demonstrate governance effectiveness, expanding community expertise in AI and DeSci evaluation, developing professional investment management capabilities, and building strategic partnerships with projects and research institutions that provide access to high-quality investment opportunities.

Long-term strategic possibilities include establishment as a recognized leader in decentralized venture capital, development of specialized expertise and reputation in AI and DeSci investment, expansion to additional technology sectors or geographic markets, and creation of comprehensive platform for community-driven investment management that influences broader venture capital industry practices.

The success of aixCB's democratic investment approach could establish new standards for community participation in venture capital while demonstrating alternative models for funding innovation that challenge traditional institutional gatekeeping and exclusive access patterns. This pioneering potential could create lasting competitive advantages and industry influence.

Technical development opportunities include enhancing AI-powered investment analysis capabilities, developing sophisticated governance tools for complex investment decision-making, creating educational resources for community investment expertise development, and building integration with broader financial services infrastructure that supports professional investment operations.

Partnership development with academic institutions, research organizations, and technology companies could enhance investment deal flow while providing access to specialized expertise and validation that strengthens community investment capabilities and attracts higher-quality projects seeking funding and support.

Educational initiatives could expand community investment expertise while attracting participants interested in AI and DeSci sectors, creating larger and more sophisticated governance participation that improves investment decision-making quality while building stronger community commitment to long-term project success.

The potential for aixCB to influence broader adoption of community-driven investment approaches could create lasting impact beyond immediate project success, establishing new models for democratic participation in innovation funding that benefit various technology sectors requiring capital and community support for development and commercialization.

Conclusion: Evaluating Decentralized Venture Capital Innovation

aixCB by Virtuals represents a groundbreaking experiment in applying blockchain technology and community governance to venture capital operations, creating a unique platform that democratizes access to early-stage investment opportunities while building engaged communities around shared objectives of funding AI and DeSci innovation. The project's ambitious approach to combining traditional investment strategies with democratic governance demonstrates potential for community-driven finance to create genuine utility beyond speculative trading.

The project's strengths include innovative governance mechanisms that enable democratic participation in venture capital decision-making, strategic focus on rapidly growing AI and DeSci sectors that could provide substantial investment opportunities, large and engaged community of over 140,000 members that provides foundation for effective governance, integration with Virtuals Protocol ecosystem that creates synergies and deal flow opportunities, and commitment to transparency and community control over investment strategies and fund management.

However, significant considerations require careful evaluation, including extreme market volatility that has resulted in 91% decline from peak values, unproven effectiveness of community governance for complex investment decision-making, competitive pressure from established venture capital firms with superior resources and track records, limited transparency about investment evaluation criteria and AI analysis methodologies, and regulatory uncertainty surrounding decentralized investment management and community-driven fund operations.

For investors and community members interested in aixCB's unique positioning, the key lies in understanding both the innovative potential of democratized venture capital and the substantial risks associated with experimental governance models that combine community participation with professional investment requirements. Those attracted to AI and DeSci investment opportunities and democratic finance approaches should approach aixCB as a high-risk investment in unproven technology that could either establish new standards for community-driven venture capital or face challenges affecting both investment performance and token value.

The broader implications of aixCB's approach extend beyond immediate investment considerations to include the potential for blockchain technology to democratize access to venture capital opportunities, demonstration of how community governance can enhance investment decision-making through collective intelligence, and establishment of new models for funding innovation that benefit both investors and entrepreneurs seeking capital and support.

As decentralized finance and venture capital continue evolving, projects like aixCB by Virtuals serve as important experiments in how these domains can create new possibilities for community participation in innovation funding while maintaining investment quality and professional capabilities. The project's ultimate success will depend on its ability to demonstrate consistent investment performance while building sustainable governance participation in the competitive landscape of venture capital and emerging technology funding.