Executive Summary

LTO Network represents a distinctive approach to enterprise blockchain adoption through its hybrid architecture that balances public verification with private data processing to meet regulatory compliance requirements. Operational since 2019 and evolved from earlier iterations, LTO has positioned itself at the intersection of real-world asset (RWA) tokenization, decentralized identities, and cross-organizational workflows. The platform's dual-layer system combines a public Leased-Proof-of-Stake blockchain for transaction verification with a private layer for confidential data processing, directly addressing GDPR and MiCA compliance requirements crucial for European enterprise adoption. LTO's novel "Ownables" technology, implementing CosmWasm-based smart contracts that execute within user wallets rather than on-chain, creates unique capabilities for dynamic digital assets without traditional gas fees. The native $LTO token, currently trading at approximately $0.050277 with a market capitalization of $22.01 million as of May 18, 2025, serves multiple functions including transaction fees, staking rewards, and governance participation. Despite demonstrating solid technical fundamentals with 3,000+ transactions per second capacity and partnerships with governmental entities including the United Nations, LTO Network faces significant challenges from its 94.42% decline from all-time high prices, competition from larger enterprise blockchain solutions, and the inherent adoption hurdles of B2B-focused platforms. For investors seeking exposure to the enterprise blockchain and RWA tokenization sectors, LTO Network offers a differentiated technological approach with proven operational history, though its investment prospects remain contingent on accelerating adoption beyond its current client base and navigating the competitive landscape of business-oriented blockchain solutions.

Key Investment Highlights

- Hybrid Architecture: Unique dual-layer design combining public verification with private data processing

- Regulatory Compliance: Built-in GDPR and MiCA compliance for European enterprise adoption

- Innovative Ownables Technology: CosmWasm-based smart contracts executed in-wallet without gas fees

- Governmental Partnerships: Collaborations with Dutch/Belgian governments and United Nations

- RWA Tokenization Focus: Recent $25 million real estate tokenization with AKRE partnership

- Long-Term Operational History: Over 6 years (2,302 days) of continuous blockchain operation

- Technical Performance: 3,000+ TPS capacity with 3-second block times exceeding many alternatives

Enterprise Blockchain Technology Analysis

Hybrid Blockchain Architecture & Regulatory Compliance

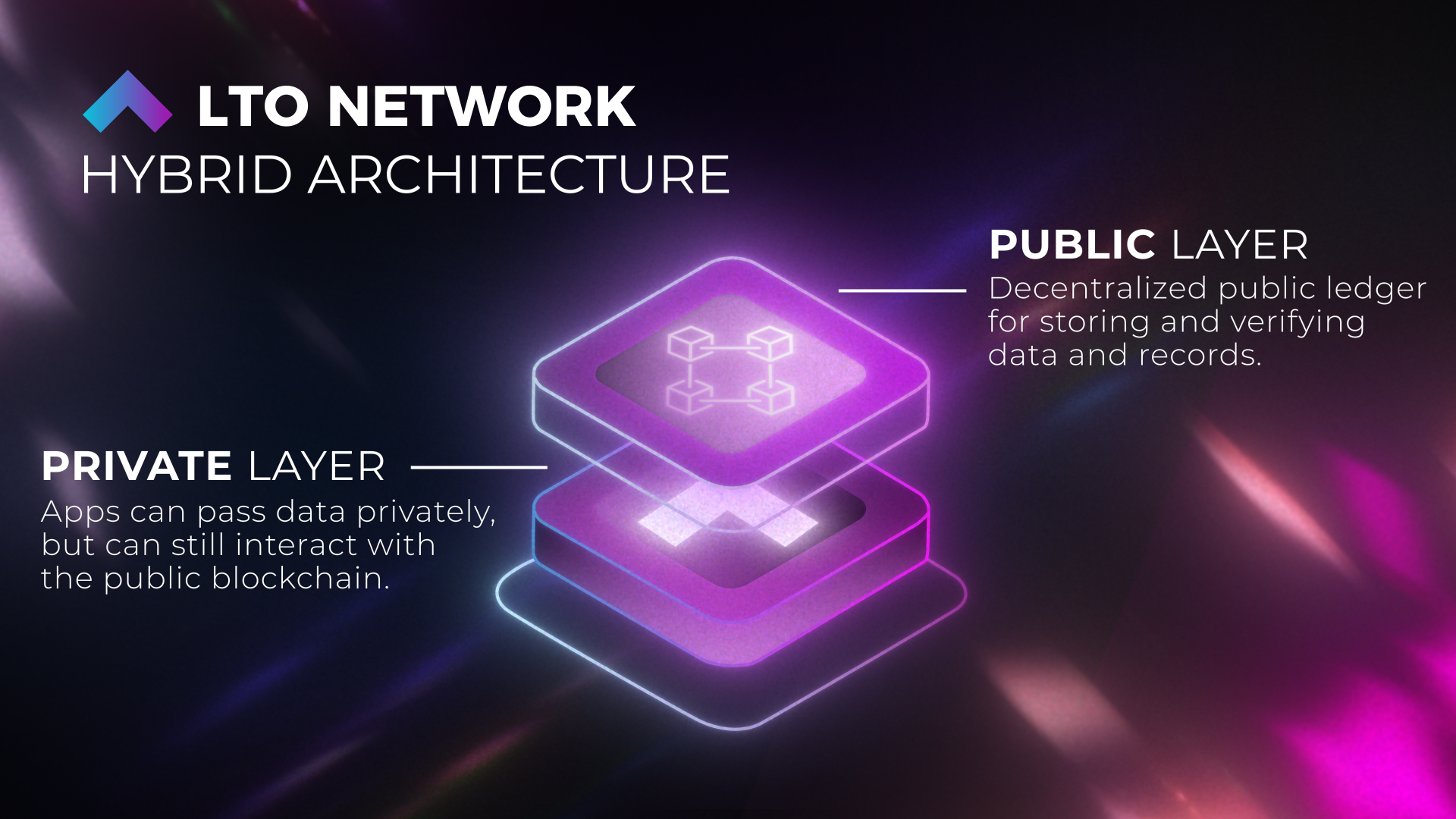

LTO Network's core technological differentiation stems from its hybrid blockchain architecture designed to address fundamental enterprise adoption barriers:

Unlike pure public blockchains that struggle with data privacy and regulatory compliance, or private chains that sacrifice decentralization and public verifiability, LTO implements a dual-layer approach optimized for business applications:

- Public Layer: The permissionless blockchain layer utilizes Leased-Proof-of-Stake (LPoS) consensus to provide immutable verification and global transaction ordering. This layer stores only cryptographic hashes of private transactions, ensuring public verifiability without exposing sensitive data. By implementing the ED25519 cryptographic standard for digital signatures, the public chain maintains robust security while minimizing computational requirements.

- Private Layer: This peer-to-peer network facilitates confidential data sharing and process execution between authorized participants. The private layer supports complex cross-organizational workflows through the LetsFlow engine, allowing businesses to automate processes like supply chain management, insurance claims, and KYC procedures without exposing proprietary information.

This architectural approach directly addresses key regulatory requirements:

- GDPR Compliance: By keeping personally identifiable information (PII) off the public chain and implementing proper data minimization principles, LTO enables GDPR-compliant blockchain implementations - a critical requirement for European enterprise adoption.

- MiCA Compatibility: The Markets in Crypto-Assets regulation creates strict requirements for crypto-asset service providers in the EU. LTO's design anticipates these requirements through its hybrid architecture and identity solutions, positioning it favorably as MiCA implementation advances.

The hybrid model creates a technical framework that balances seemingly contradictory requirements: public verifiability with private data processing, decentralization with regulatory compliance, and scalability with security. This balanced approach potentially unlocks enterprise use cases that remain challenging for single-layer blockchain architectures.

Ownables: Revolutionary Smart Contract Implementation

LTO Network's "Ownables" technology represents a fundamental reimagining of digital asset implementation:

Traditional NFTs and smart contracts face several limitations: they typically store only references to assets on-chain, require gas fees for every interaction, and expose all data publicly. Ownables addresses these constraints through a novel approach:

- In-Wallet Execution: Unlike conventional smart contracts that execute on-chain, Ownables run directly within the user's wallet environment. This architectural shift eliminates gas fees for most operations and enables private content and computation.

- CosmWasm Foundation: Built on the CosmWasm standard, Ownables inherit a mature, security-focused smart contract framework while extending it with LTO-specific capabilities for dynamic content and cross-chain compatibility.

- Dynamic Content Support: Unlike static NFTs, Ownables can contain dynamic, updatable content and programmable behaviors. This enables use cases like consumable digital items, evolving collectibles, and interactive media assets.

- Private Content Capabilities: The wallet-based execution model allows for encrypted content that remains private to the owner or specific authorized parties, enabling sensitive applications like identity credentials or confidential business documents.

This implementation creates several advantages for RWA tokenization and digital collectibles:

- Cost Efficiency: Elimination of per-interaction gas fees makes micro-transactions and frequent updates economically viable

- Enhanced Privacy: Selective disclosure capabilities align with business confidentiality and regulatory requirements

- Improved User Experience: Reduced latency and costs for interactions with digital assets

- Complex Behavior Support: Programmable assets that can evolve based on conditions or user actions

The Ownables SDK update in April 2025 further enhanced these capabilities, providing developers with improved tools for creating sophisticated digital assets. This technology potentially creates a foundation for RWA applications that more accurately reflect the complex, dynamic nature of real-world assets than traditional static NFT implementations.

Cross-Organizational Workflow Engine

LTO Network's LetsFlow workflow engine addresses a critical challenge in enterprise blockchain adoption:

Business processes rarely occur within single organizational boundaries. Supply chains, legal agreements, insurance claims, and regulatory compliance all involve multiple independent parties with different systems and trust requirements. LetsFlow creates a distributed workflow environment that enables:

- Deterministic Process Execution: Standardized, verifiable process steps that execute according to predefined rules, ensuring all parties follow the same procedures.

- Cross-Organizational Coordination: Automated handoffs between different entities without requiring a central authority or shared infrastructure beyond the LTO Network.

- Selective Information Sharing: Granular control over which data is shared with which participants, maintaining confidentiality while enabling collaboration.

- Cryptographic Verification: Each process step is cryptographically signed by the relevant parties, creating an immutable audit trail without exposing the underlying data.

This workflow engine has demonstrated practical applications in collaboration with governmental entities and enterprise partners, validating its effectiveness for real-world business processes. The technology provides a foundation for digitizing complex multi-party workflows while maintaining the security, privacy, and compliance requirements of enterprise environments.

Token Economics & Market Analysis

$LTO Token Metrics

| Metric | Value (as of May 18, 2025) |

|---|---|

| Token Type | Utility & Governance Token |

| Total Supply | 438,900,000 LTO |

| Circulating Supply | 438,010,000 LTO (87.60%) |

| Current Price | $0.050277 USD |

| Market Capitalization | $22,014,656 USD |

| Fully Diluted Valuation | $22,015,534 USD |

| 24-Hour Trading Volume | $1,757,313.88 USD |

| Volume/Market Cap Ratio | 7.98% |

| All-Time High | $0.901021 USD (2021) |

| All-Time Low | $0.01589931 USD (2022) |

| 24-Hour Price Change | +32.24% |

| 7-Day Price Change | +71.95% |

Token Utility & Value Accrual Mechanisms

The $LTO token incorporates multiple utility functions within the LTO Network ecosystem:

- Transaction Fees: The token serves as the native payment method for network operations, with near-zero gas fees compared to many alternative blockchains. This utility creates baseline demand proportional to network usage.

- Staking Rewards: Token holders can participate in the Leased-Proof-of-Stake consensus by staking tokens directly or leasing them to validator nodes. This mechanism allows participation in network security without technical expertise, with returns reportedly up to 10% APY for one-year commitments. The current 172 million staked coins represent a significant portion of the circulating supply, reducing available trading supply while enhancing network security.

- Governance Participation: $LTO enables voting rights in ecosystem decisions through the REI DAO, creating value through influence over protocol parameters, feature development, and resource allocation.

- Deflationary Burn Mechanism: 50% of transaction fees are burned, creating a deflationary pressure mechanism that increases with network usage. This burn process has already reduced the maximum supply from 500 million to approximately 438.9 million tokens, demonstrating tangible impact on circulating supply.

- Validator Collateral: The token serves as collateral for node operators, aligning incentives for honest validation while creating additional token demand for prospective validators.

These utility functions collectively establish multiple demand vectors that theoretically increase with network adoption. The combination of transaction fee requirements, staking incentives, and deflationary mechanisms creates a framework where increasing network usage could drive long-term token value beyond pure speculation.

Supply Distribution & Market Performance

The $LTO token has experienced significant market volatility since its January 2019 ICO:

The token's initial offering price of approximately $0.03 represented a substantial discount to its eventual all-time high of $0.901021 in 2021, delivering early investors significant returns during the bull market. However, the subsequent decline to the current price of $0.050277 represents a 94.42% drawdown from peak valuation, though still maintaining a 67.6% premium over the initial offering price.

Recent market activity shows notable momentum, with a 32.24% 24-hour gain and 71.95% weekly increase as of May 18, 2025. This positive price action indicates potential renewed market interest, though the 9.30% decrease in trading volume suggests some consolidation of the recent gains.

The token's supply distribution appears relatively mature, with 87.60% of the total supply already in circulation, creating minimal future dilution risk compared to many cryptocurrency projects with more significant unvested allocations. The small gap between market capitalization ($22.01 million) and fully diluted valuation ($22.02 million) further reinforces this limited dilution outlook.

The $LTO token's trading activity appears moderate relative to its size, with the volume-to-market-cap ratio of 7.98% indicating reasonable but not exceptional liquidity for a token of this market capitalization. This liquidity profile suggests sufficient trading depth for individual investors but potentially limited capacity for large institutional positions without significant price impact.

Competitive Landscape Analysis

Enterprise Blockchain Ecosystem Positioning

LTO Network operates in the competitive enterprise blockchain sector:

| Competitor | Key Differentiator | Target Market | Market Cap |

|---|---|---|---|

| Hyperledger | Private consortium chains | Global enterprises | N/A (No token) |

| Polygon | Public L2 with enterprise features | General audiences & businesses | $7B+ |

| R3 Corda | Financial industry focus | Banking & insurance | N/A (Private) |

| Hedera | High-throughput public DLT | Enterprises & developers | $1.9B |

| Quant | Blockchain interoperability | Financial institutions | $1.1B |

| LTO Network | Hybrid architecture, RWA focus | European enterprises | $22M |

LTO's positioning within this competitive landscape emphasizes its hybrid architecture and European regulatory compliance as principal differentiators. Unlike purely private solutions like Hyperledger or R3 Corda that sacrifice decentralization, or fully public chains like Polygon that face privacy challenges, LTO attempts to capture the benefits of both approaches through its dual-layer design.

The platform's current market capitalization of $22 million places it substantially below larger competitors, potentially indicating either undervaluation relative to technological capabilities or limited market recognition of its differentiated approach. This valuation gap creates both opportunity (potential for significant appreciation if adoption accelerates) and risk (limited resources compared to better-funded competitors).

LTO's focus on RWA tokenization, particularly in European markets with stringent regulatory requirements, represents a potentially valuable niche within the broader enterprise blockchain landscape. The recent $25 million real estate tokenization partnership with AKRE demonstrates practical implementation of this focus, though the scale remains modest compared to the multi-trillion-dollar potential of the global RWA market.

Competitive Advantages & Challenges

Advantages:

- Regulatory Compliance: LTO's built-in GDPR and MiCA compliance provides a significant advantage for European enterprise adoption, reducing legal barriers that often impede blockchain implementation in regulated industries.

- Proven Operational History: With over 6 years (2,302 days) of continuous operation, LTO has demonstrated technical stability beyond many blockchain projects, providing confidence in system reliability.

- Governmental Validation: Partnerships with Dutch and Belgian governments and the United Nations provide credibility and use case validation that many competitors lack, particularly valuable for attracting additional government and enterprise clients.

- Technical Innovation: The Ownables implementation represents genuine innovation in digital asset technology, potentially creating lasting competitive advantage in RWA tokenization and digital collectibles.

- Cross-Organizational Focus: The LetsFlow workflow engine specifically addresses multi-party business processes, a common enterprise requirement that many blockchain platforms handle poorly.

Challenges:

- Limited Market Recognition: Despite solid technical fundamentals, LTO has achieved less market visibility than many competitors, potentially limiting partnership opportunities and adoption velocity.

- Resource Constraints: With a $22 million market capitalization, LTO has substantially fewer resources for development, marketing, and business development than billion-dollar competitors.

- B2B Adoption Cycle: Enterprise blockchain faces inherently longer sales cycles and more complex implementation requirements than consumer-focused applications, potentially limiting growth velocity.

- Specialized Knowledge Requirements: The hybrid architecture and unique features like Ownables create a learning curve for developers and integrators, potentially slowing ecosystem expansion.

- Token Market Performance: The 94.42% decline from all-time high creates negative market perception that may impact investor interest despite technological progress.

Development Roadmap & Growth Analysis

Historical Milestones & Execution

LTO Network has demonstrated consistent development progress since its inception:

| Date | Milestone | Achievement |

|---|---|---|

| January 2019 | Initial Coin Offering | Raised ~$4.03M at $0.03 per token |

| December 2020 | VIDT Dataline Merger | Enhanced document certification capabilities |

| 2021-2023 | Hybrid Architecture Development | Established dual-layer framework |

| January 2025 | 2025 RWA Roadmap Announcement | Strategic focus on real-world asset tokenization |

| April 2025 | AKRE Partnership | Tokenized $25M in real estate properties |

| April 2025 | First RWA Airdrop | Pioneered compliant RWA distribution model |

| April 2025 | EQTY BETA Testing | Advanced RWA platform development |

| April 2025 | Ownables SDK Update | Enhanced developer tools for digital assets |

This development timeline demonstrates a strategic evolution from initial blockchain infrastructure toward specialized RWA tokenization capabilities, aligning with broader market trends toward tokenizing traditional assets. The consistent development progress despite market volatility indicates technical commitment beyond token price performance.

The April 2025 milestones, including the AKRE partnership and first-ever RWA airdrop, represent particular validation of the platform's RWA strategy, demonstrating practical implementation rather than purely theoretical capabilities.

2025 RWA Roadmap & Strategic Direction

LTO Network's January 2025 roadmap announcement outlined several strategic priorities:

- Solana Bridge Development: Planning to connect with the high-performance Solana ecosystem, potentially expanding market reach and interoperability.

- EQTY Platform Launch: A comprehensive solution for end-to-end RWA lifecycle management, including tokenization, due diligence, KYC, and legally compliant trading. The April 2025 beta testing suggests progression toward this objective.

- Enhanced Ownables Capabilities: Continued development of the unique smart contract implementation, with the April 2025 SDK update representing concrete progress in this direction.

- Proofi Integration: Expanding decentralized identity capabilities for improved KYC and AML compliance, addressing critical requirements for regulated asset tokenization.

These strategic priorities collectively establish a coherent focus on RWA tokenization as the platform's primary growth vector, leveraging its regulatory compliance advantages and hybrid architecture to address a potentially massive market. The recent real estate tokenization partnership provides initial validation of this approach, though significant scaling would be necessary to capture meaningful market share in the global RWA sector.

The planned mobile application enhancements for the Universal Wallet suggest attention to user experience, potentially addressing adoption barriers beyond pure technological capabilities.

Risk Assessment & Investment Considerations

Critical Risk Factors

- Market Performance Disconnect: The 94.42% decline from all-time high despite continued development creates a significant disconnect between token price performance and technological progress, raising questions about market perception versus fundamental value.

- Enterprise Adoption Velocity: B2B blockchain projects typically face slower adoption cycles than consumer applications, creating potential challenges in demonstrating near-term growth metrics attractive to crypto investors accustomed to rapid scaling.

- Competitive Pressure: The enterprise blockchain sector includes well-resourced competitors with stronger brand recognition and larger partner networks, potentially limiting LTO's ability to capture market share despite technological differentiation.

- Team Concentration Risk: While key leadership figures like CEO Rick Schmitz and CFO/COO Martijn Migchelsen bring relevant experience, limited public information about the broader development team creates some uncertainty about execution capabilities.

- RWA Regulatory Evolution: Despite built-in GDPR and MiCA compliance, the regulatory landscape for tokenized real-world assets continues to evolve, potentially creating unexpected compliance requirements or limitations.

- Cross-Border Operational Challenges: While well-positioned for European market requirements, global expansion would encounter different regulatory frameworks that might require significant adaptation of the platform's compliance mechanisms.

Potential Growth Catalysts

Several potential catalysts could drive LTO Network's development and token appreciation:

- RWA Market Expansion: The tokenized real-world asset market represents a multi-trillion-dollar opportunity if even modest portions of traditional assets migrate to blockchain. LTO's regulatory-compliant approach could capture significant value in this transition.

- Additional Enterprise Partnerships: Expansion of the partnership portfolio beyond current relationships could validate the technology for broader adoption, particularly if including recognized global enterprises.

- Governmental Implementation Scaling: Given existing relationships with Dutch and Belgian governments and the United Nations, expanding these implementations could create significant usage growth and institutional credibility.

- Ownables Adoption Acceleration: If the unique smart contract implementation gains traction for digital collectibles or enterprise applications, it could create distinctive competitive advantage and usage growth.

- EQTY Platform Success: The comprehensive RWA management platform, if successfully launched and adopted, could establish LTO as a leader in the emerging tokenized asset sector.

These potential catalysts suggest multiple plausible growth vectors, though realization depends on execution quality and market timing beyond technological capabilities alone.

Technical Analysis & Market Outlook

With $LTO currently trading at $0.050277, technical analysis reveals several noteworthy patterns:

The token's 32.24% 24-hour gain and 71.95% weekly increase suggest significant positive momentum, potentially establishing a new uptrend after extended consolidation. This price action represents a 216.14% recovery from the all-time low of $0.01589931, indicating substantial base building despite remaining 94.42% below all-time highs.

Key technical levels to monitor include:

- Support: $0.045 (recent breakout level), $0.035 (prior resistance now support)

- Resistance: $0.060 (psychological level), $0.075 (significant historical level)

The 9.30% decrease in daily trading volume suggests some consolidation of recent gains, though the volume-to-market-cap ratio of 7.98% indicates reasonable liquidity for a token of this capitalization. The bullish community sentiment (87% positive on CoinMarketCap) aligns with recent price performance, potentially supporting continued positive momentum if fundamental developments materialize.

The extreme discount from all-time high (94.42%) while maintaining premium over ICO price (67.6%) creates an interesting risk-reward dynamic, suggesting potential asymmetric upside if adoption metrics improve but relatively limited downside to initial funding valuation.

Conclusion & Investment Recommendation

LTO Network represents a differentiated approach to enterprise blockchain implementation through its hybrid architecture combining public verification with private data processing. The platform's built-in regulatory compliance, novel Ownables technology, and focus on RWA tokenization create a distinctive positioning within the competitive blockchain landscape. With demonstrated partnerships including governmental entities, successful tokenization of $25 million in real estate assets, and a clear roadmap for 2025, LTO shows meaningful development progress despite significant token price volatility.

The $LTO token, currently valued at approximately $22 million market capitalization, incorporates multiple utility functions including transaction fees, staking rewards, and governance rights, with a deflationary burn mechanism that has already reduced total supply. Recent price momentum (32.24% 24-hour gain, 71.95% weekly increase) suggests renewed market interest, though still trading 94.42% below all-time highs.

Key strengths include regulatory compliance advantages, proven operational history, governmental partnerships, and technical innovations like Ownables. Significant challenges remain in market recognition, resource constraints relative to competitors, enterprise adoption velocity, and bridging the disconnect between technological progress and token price performance.

Recommendation: MODERATE BUY with appropriate position sizing

For investors specifically seeking exposure to enterprise blockchain and RWA tokenization:

- Consider moderate position sizing appropriate to the speculative nature of small-cap cryptocurrencies

- Implement dollar-cost averaging to mitigate volatility risk

- Monitor key adoption metrics including new partnerships, transaction volumes, and RWA implementations

- Watch for successful EQTY platform launch as potential inflection point for adoption

- Track token burn impact on circulating supply as potential price support mechanism

The combination of regulatory compliance advantages, proven technological capabilities, and current valuation creates favorable risk-reward dynamics for risk-tolerant investors seeking exposure to the enterprise blockchain sector. However, the inherent adoption challenges of B2B-focused platforms and significant competition demand appropriate risk management through position sizing and investment time horizon expectations.

This recommendation specifically applies to investors with moderate risk tolerance seeking diversified blockchain exposure beyond mainstream cryptocurrencies, rather than conservative investors or those requiring near-term returns.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Cryptocurrency investments involve significant risk, including the potential loss of principal. Thorough due diligence should be conducted before making any investment decisions.